Mutual fund compounding calculator

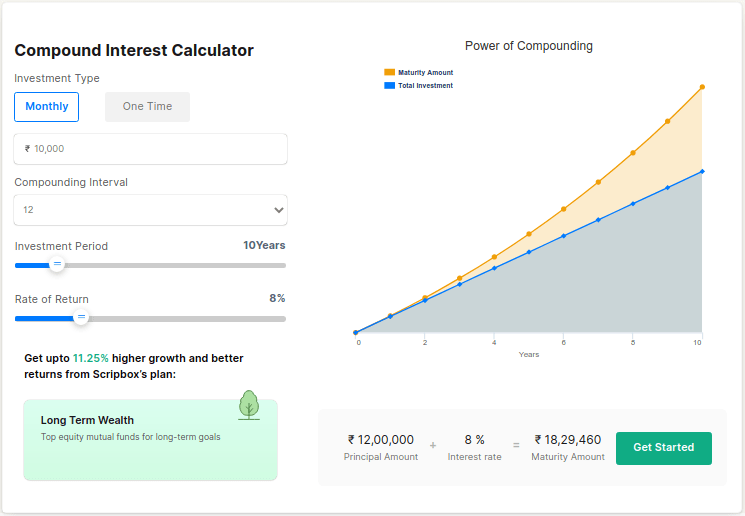

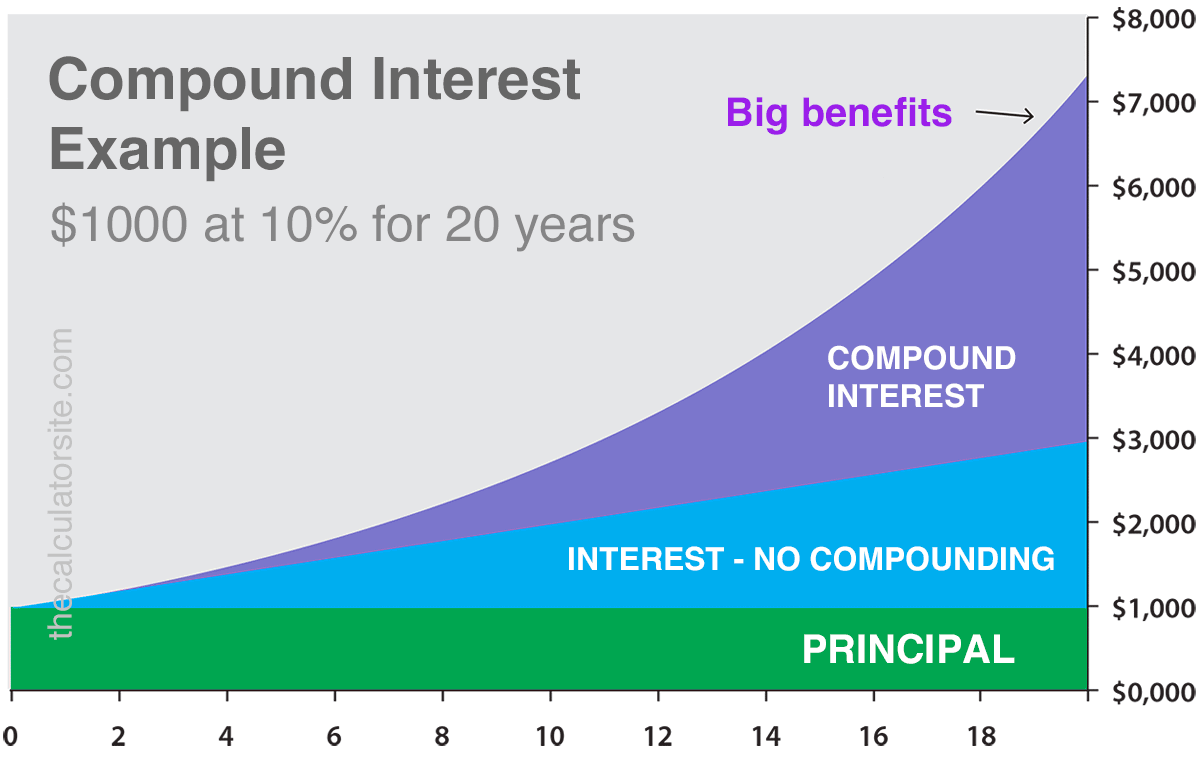

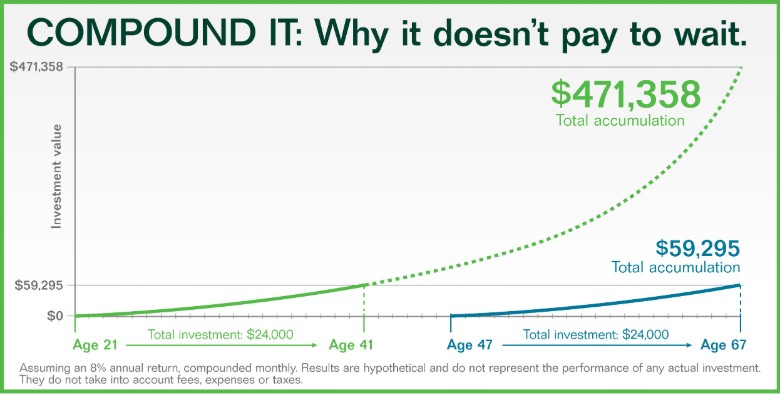

However do keep in mind that the results provided by an SIP. Compound interest or compounding means you not only receive the interest on the basic principal amount that you have invested but also on the interest that keeps getting added to it.

Compound Interest Calculator Set Your Own Compounding Periods

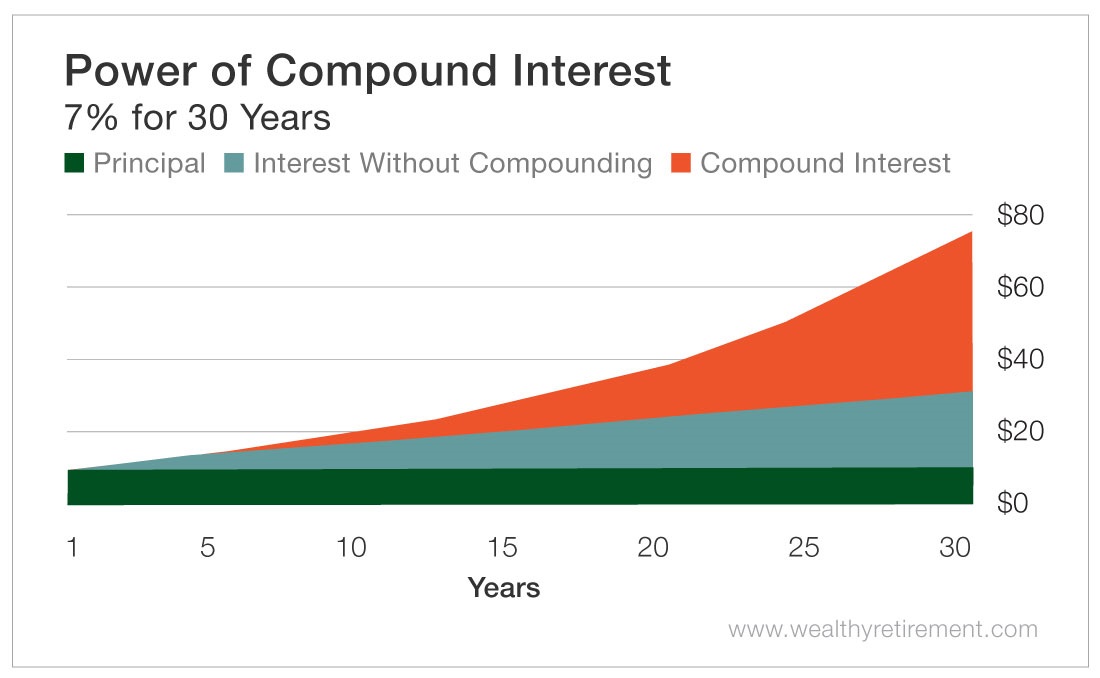

Power of compounding is a money multiplier strategy used in Mutual Funds.

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

. For example if you invest Rs. The formula is A P 1 rn nt The variables in the formula are the following. For example let us assume that you invest 100000 with average annual returns of 15 per annum compounded quarterly.

A P 1 rn nt The variables are mentioned in the table below. Compound interest is the eighth wonder of the world. The basic formula to calculate the compounded interest is A P 1rn nt Where A Final amount at the end of the term P Principal amount or initial investment r compounding rate of interest.

1000 made for 12 months with an expected return of 15 will give you a final value of Rs. For new investors trying to use any other Mutual Fund returns calculator in India this can be quite overwhelming. Under this the interest earned on principal is reinvested so as to earn interest on interest or profit on profits.

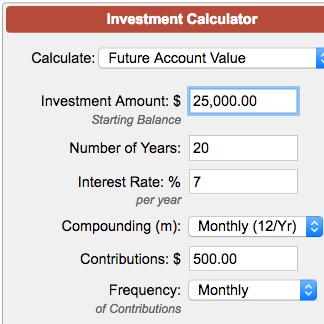

The calculator works on the following formula- A P 1 rn nt Here. For example an SIP of Rs. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

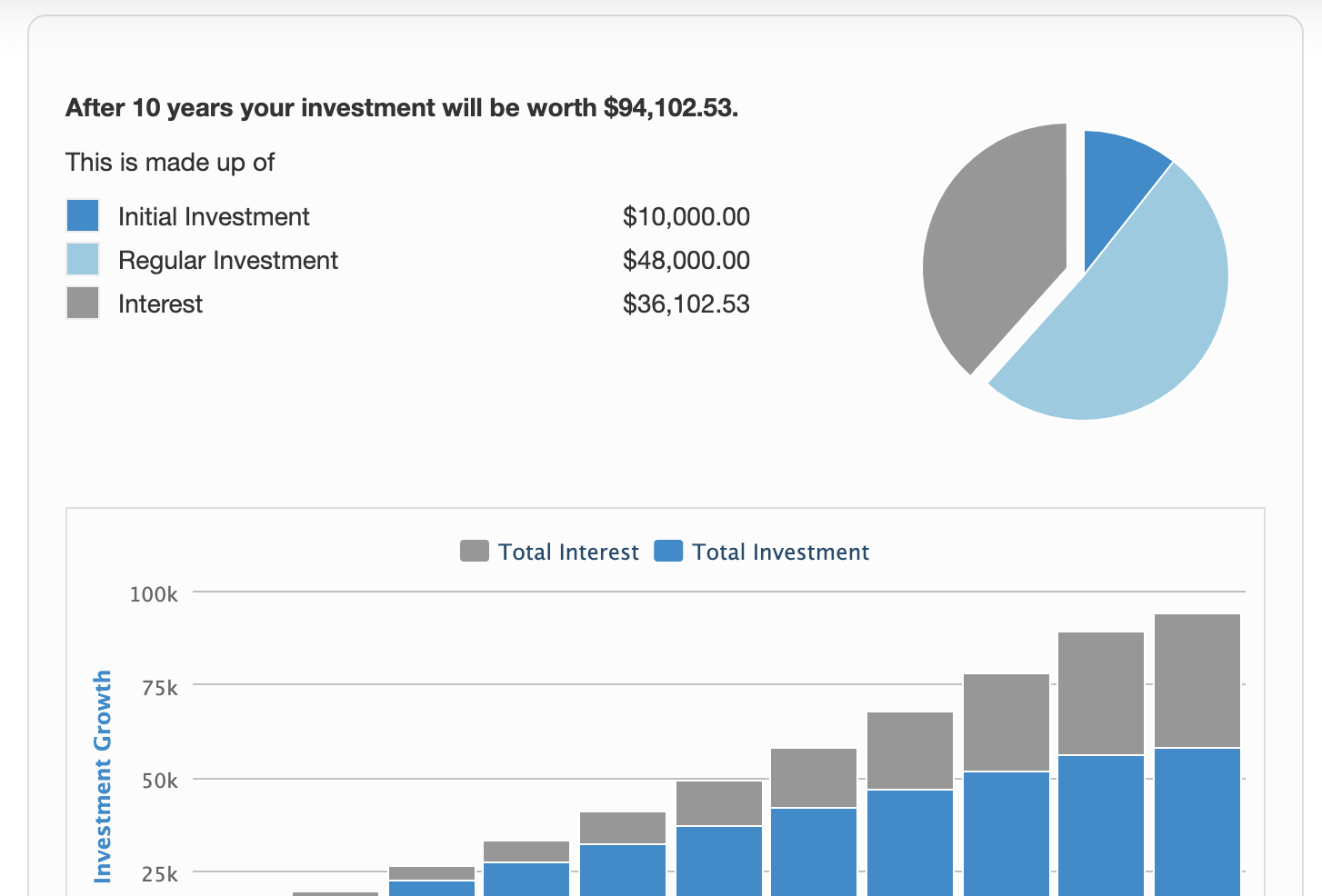

In the above formula M is the amount you receive upon maturity. Compounding of interest has been instrumental in generating wealth for many investors. It is essentially a compound interest formula with one of the variables being the number of times the interest is compounded in a year.

Thus the power of compounding helps to multiply your wealth at a faster rate. Length of Time in Years. Now enter the compounding interval which is yearly half- yearly quarterly monthly 3.

Length of time in years that you plan to save. N is the number of payments you have made. You can also use a compound interest calculator to calculate returns on investments that offer compounding returns like mutual funds.

All lumpsum calculator mutual fund uses a specific method to compute the estimated return on investment. This strategy allows the interest earned to also earn interest leading to a growth in the value of investment. Based on these inputs the online tool can instantly provide estimated returns for the investment.

To find out the level of compounding you can use the. Choose between a lump sum or SIP calculation from the top-right corner. He who understands it earns it.

A compound interest calculator makes it easier to calculate compound interest so that you dont need to make any manual calculations. The formula is as follows. Ad Learn More About American Funds Objective-Based Approach to Investing.

A SIP plan calculator works on the following formula M P 1 in 1 i 1 i. An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now. Enter the amount to be invested under the TAB invested amount.

P is the amount you invest at regular intervals. If you need help with your investments we recommend working with an expert wholl help you understand what youre investing in. But rememberan investment calculator doesnt replace professional advice.

I is the periodic rate of interest. The concept is simple yet effective the interest earned on your principal investment is added. As mentioned above a compound interest calculator requires the investors to provide few basic parameters for getting the final fund value.

50000 with an annual interest rate of 10 for 5 years the returns for the first year will be 50000 x 10100 or Rs. For example if you invest Rs 100 with 8. Formula to Calculate Mutual Fund Returns The lumpsum calculator requires the investor to enter details like the total investment amount expected return rate and time period.

Enter the time period for which you want to invest your money. This is why the ET Money calculator has a streamlined design that helps investors with mutual fund return calculation in two easy steps. Groww uses a globally standardized method to determine the total compound interest accrued.

All you need to enter into the calculator is the SIP installment amount the expected rate of return and the duration of the SIP to get an answer within seconds. Suppose youre trying to analyse your investments maturity value. Then three years later the value of your investment at redemption will be 155545.

Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. It essentially means reinvesting the earnings you get from your initial invested amount instead of spending it elsewhere.

Fidelity Compound Interest

The 100 Year Time Tested Method For Compounding Returns In The Stock Market Trade That Swing

Compound Interest Calculator With Formula

Power Of Compounding Investment Calculator Scripbox

Investment Calculator

Investment Growth Calculator Store 60 Off Www Wtashows Com

Compound Interest Calculator

Compound Interest Formula And Financial Calculator Excel Template

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

What Is The Link Between Mutual Funds And Compound Interest

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Investor Gov

The Power Of Long Term Compound Interest Investments Ticker Tape

Compound Interest Formula With Graph And Calculator Link

Compound Interest Formula Examples And Explanations Investing To Thrive

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Calculator Begin To Invest

Compound Interest Calculator Arrest Your Debt